We m s jagdish chand co j c gupta praveen kumar jain pankaj aggarwal chartered accountants do hereby declare that being accountants we are duly qualified under section 288 of income tax act 1961.

Power of attorney format for authorised signatory for income tax.

Authorized signatory signature of authorised signatory and name and designation date and place.

Authorised signatory income tax authorised signatory income tax form signature signature on income tax form indian income tax signatory income tax return signature signature by authorised person return filing form signature on return filing form assessee signature personal signature on form authorised assessee income tax payment signature by income tax payee individual signature.

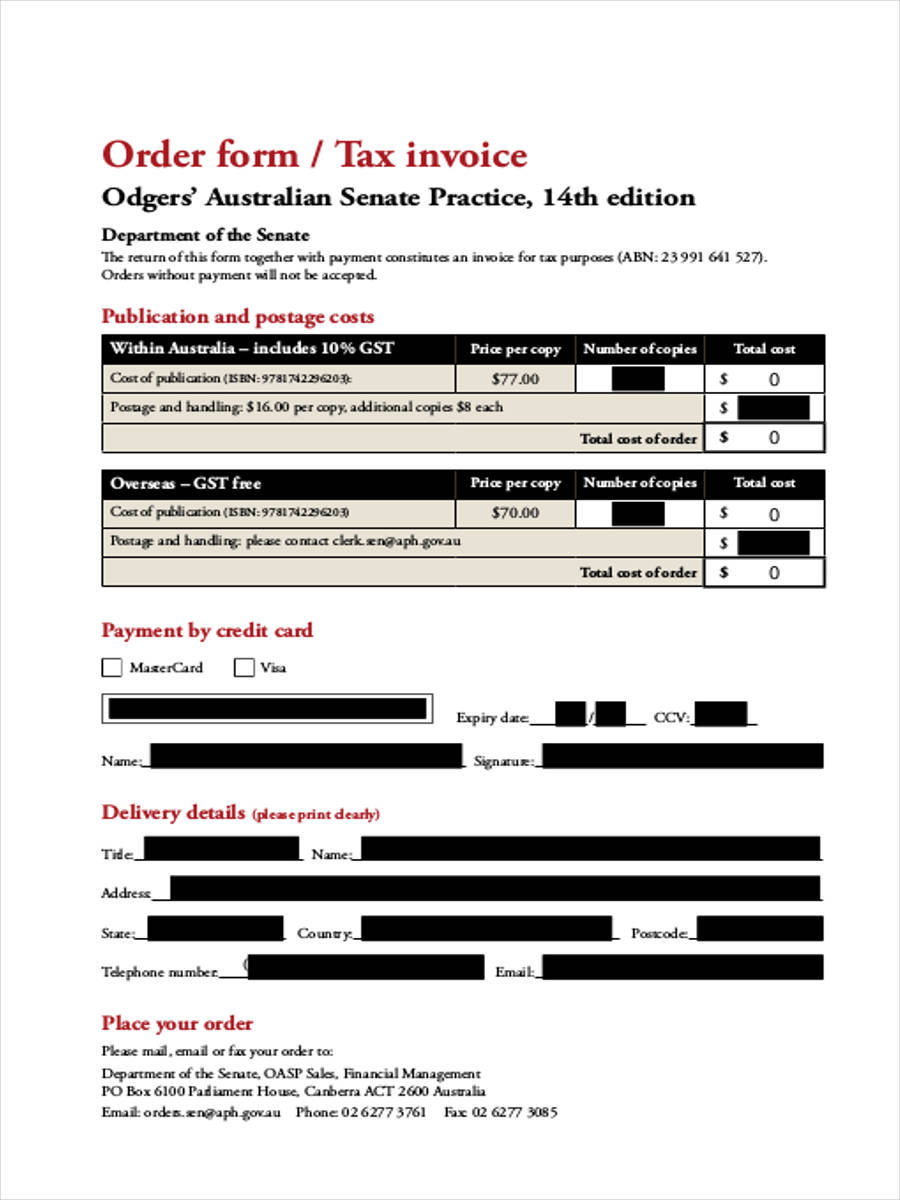

The following methods may be used to authorize power of attorney.

Authorized representative declaration power of attorney form mcl 205 28 1 f strictly prohibits employees of the department of treasury from disclosing confidential tax information to anyone other than the individual taxpayer or his or her authorized representative.

Form pa 1 special power of attorney for use by.

Line 3 should list either forms 1041 or 990 t if.

A written document creating a lawful power of attorney also referred to as general power of attorney designating authority to prepare and file a tax return on behalf of the taxpayer.

For such kind of situations e filing portal of income tax department has come up with a facility names as add register as representative.

For a representative to be given access each tax type and tax period must be listed on form m 2848.

Generally the fiduciary must submit form 56.

Only the individual s listed on the form 56 have the authority to sign the form 2848 or form 8821.

We accept the power of authorisation and acknowledge to perform our duties as per the applicable laws and rules and perform our duties and responsibilities deligently.

Various sections under income tax act 1961 envisages many situations where a person would not be able to attend to their income tax related affairs on their own.

123 miss ccc chartered accountants for m s name of the ca firm.

They are also authorised to file all appeals in connection with the above assessment and sign and verify all documents connected therewith.

Documents authorizing power of attorney.

Note that a representative cannot receive the taxpayer s refund.

The trustee executor or other fiduciary responsible for filing the form 1041 return.

A family member acting as an authorized representative requires a signed poa form except when a parent is acting on behalf of a minor child.

Signed by the trustee executor or fiduciary with the authority to bind the trust or estate listing the ein from the form 1041.